Fiscalisation of BouquetMat revenues

Bouquets from BouquetMat have become very popular. This form of sale is a great convenience for flower shops, it allows to increase the availability of bouquets, but it is also a convenience appreciated by customers, who can now buy a bouquet from their favorite flower shop at any time, choosing from BouquetMat’s current offers.

BouquetMat’s popularity is now a fact

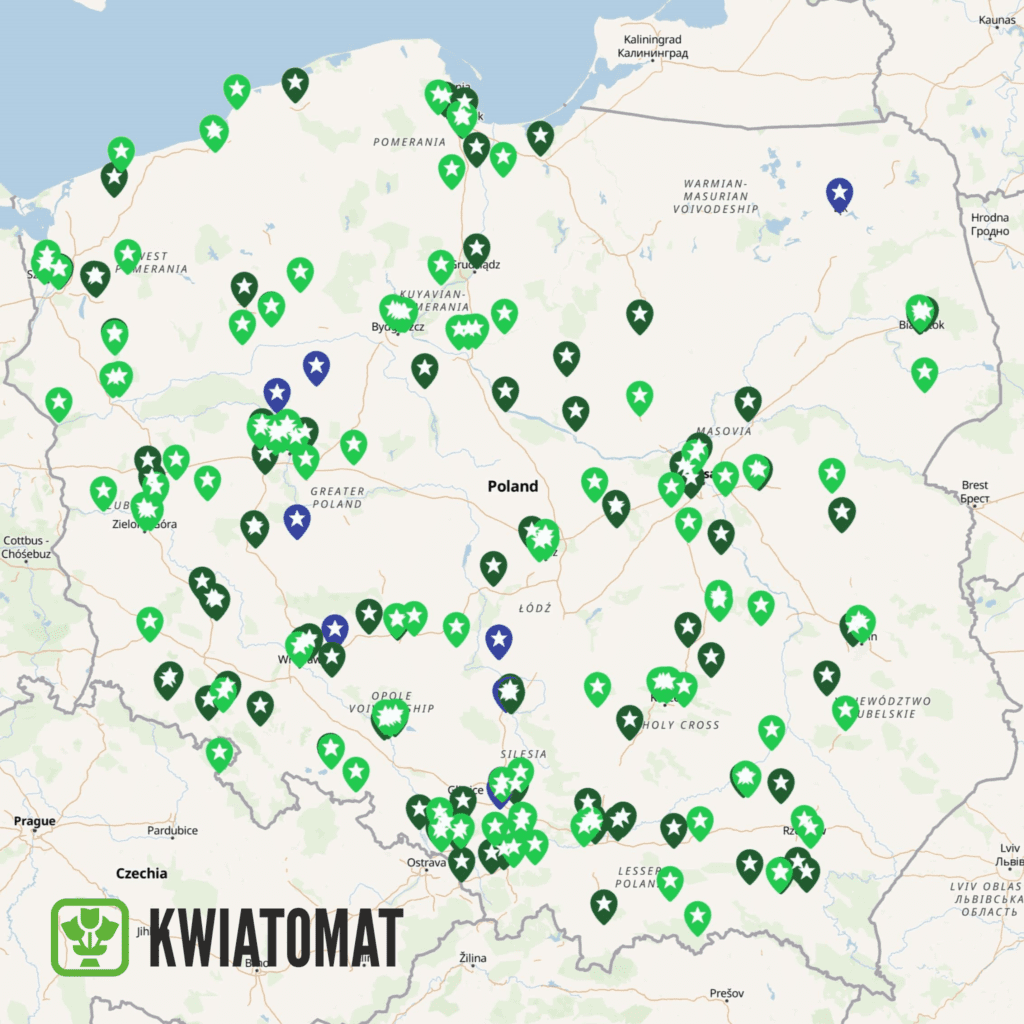

Hundreds of flower vending machines recently installed in the florist industry made it possible to reduce the hours of operation of many flower shops and to close flower shops on Sundays and holidays without loosing the option to sell bouquets. This self-service sales option eventually allows flower shop staff to relax more and attend to things other than work. The automated sales process undoubtedly has the effect of reducing the flower shop’s operating costs, while increasing revenue. BouquetMats are a great idea for modern times. For flower shops in operation, where there is a florist, there are flowers, there is spare capacity, there is a driver and a car, the ability to sell from BouquetMat greatly optimizes the use of company resources. Now we no longer need to open another flower shop in the near and far neighborhood to sell our bouquets, this can be done for us by a vending machine, which, by the way, is a great advertisement for our flower shop’s brand.

More BouquetMats are being installed on the streets of Polish cities, thanks to which the offer of beautiful flower bouquets from local flower shops has become even more accessible. Now there are no more translations – “I didn’t buy a bouquet because the flower shop was already closed”. Self-service vending machines generate a lot of revenue, and do not require the involvement of employees in the sales process. When deciding on such a form of business, it is worth knowing about tax and cash register obligations.

What is it like to fiscalize sales from BouquetMat?

Many BouquetMat owners ask themselves at some point – and how is it with sales taxation, how is it with fiscal receipts? The answer is simple – the sale of flower bouquets in vending machines requires payment of taxes according to the general rules. Earning revenue from self-service sales in vending machines is not regulated by separate rules. There is, however, a small exception – despite the fact that mostly the customers are natural persons, it is not required to be fiscalized with a cash register. This follows from item 39 of the appendix to the Regulation of the Minister of Finance of July 26, 2010 on exemptions from the obligation to keep records using cash registers (Journal of Laws No. 138, item 930).

The Ministry of Finance has provided special solutions for the sale of goods or services by means of vending machines – according to the regulation on exemptions from the obligation to use cash registers, such an exemption applies to the supply of products, made with the use of automatic sales devices, which in a self-service system accept payment and issue goods. Thus, when selling a bouquet through BouquetMat, recording revenue with a fiscal cash register is not necessary.

Correct revenue recording from BouquetMat

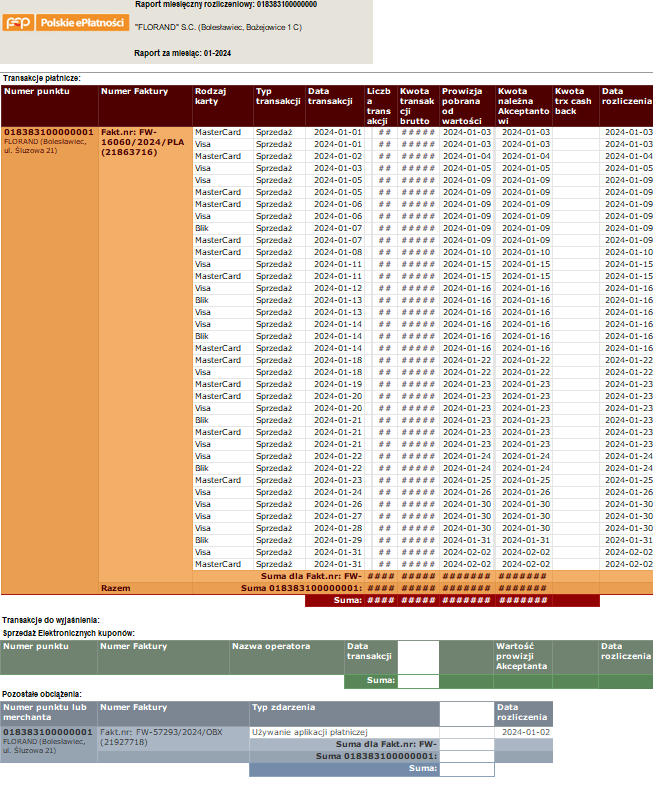

Despite BouquetMat’s exemption from the cash register requirement, the taxpayer must record his non-cash sales in such a way that he can properly prepare his VAT return. The regulations do not specify the form in which such sales records are to be kept. Thus, a report prepared from the collection of cash from a vending machine, as well as any other reliable form of documenting sales adopted by the taxpayer, may be sufficient.

This does not mean, however, that the owner of a BouquetMat should check every day how many bouquets and for what amount he sold through each vending machine – it is sufficient to show the transactions made at the end of the accounting period. Due to the content of Article 19(17) of the VAT Act, he should organize his business in such a way that cash collection for a given month does not take place later than on the last day of that month. In such a situation, it is necessary to select and count the funds, accumulated in the machine. The coins selected from the vending machine can be included in the VAT sales records, for example, on the basis of an internal receipt. In the case of non-cash settlements, it is necessary to collect a monthly report from the operators mediating electronic transactions and, on its basis, make a settlement of sales from BouquetMat.

VAT records of BouquetMat revenue

It is also necessary to determine what products were sold to determine the correct VAT rates. In the case of sales of bouquets and flowerboxes of cut flowers, this is straightforward because there is a single VAT rate, currently 8%.

Possible legal changes on the topic of fiscalization of sales from self-service vending machines

Flower shop owners who sell bouquets using BouquetMats or plan to purchase a BouquetMat should be prepared for changes in legislation. Legislators may in the future make it mandatory to record sales transactions and reinstate the need to install cash registers in vending machines. Currently, there is no detailed information on the new regulations, which creates some uncertainty among entrepreneurs. There is a risk that not all currently operating BouquetMats will be able to be adapted to the new requirements, especially if it involves older machine models or those using outdated interfaces used in cheaper versions of the machines. Such possible modifications may also be associated with high costs for entrepreneurs.

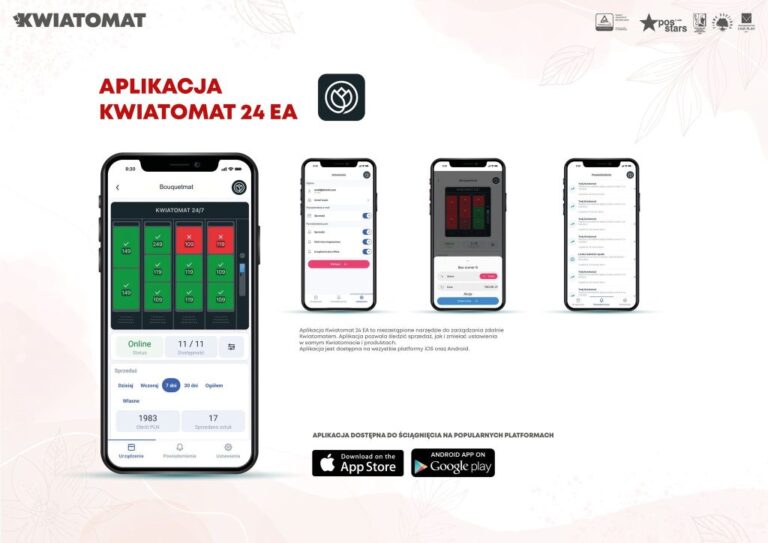

We have a lot of experience with vending machines operating in other European countries, where we deal with different requirements. For example, we prepared BouquetMat for the Romanian market, where there is an obligation to fiscalize and print receipts after selling a bouquet from a BouquetMat. Our vending machines also operate in countries where there is no obligation to print receipts, but sales must be recorded in the fiscal memory. Thus, we are ready for different situations and our interface is adapted to possible changes in tax laws regarding the fiscalization of sales from vending machines.

We are constantly monitoring legislative progress and are ready for any changes in the regulations. We are in constant contact with relevant institutions and experts for detailed information and support in adapting to the changing legislation. One option, for example, in the case of non-cash settlements, is for operators of self-service payment terminals to take over the recording of sales.

Accounting for revenue from BouquetMat in Poland requires compliance with relevant legal regulations and accuracy in bookkeeping. Ensuring compliance with fiscal requirements and proper documentation of transactions will avoid potential tax problems and ensure proper accounting of revenue from this source.